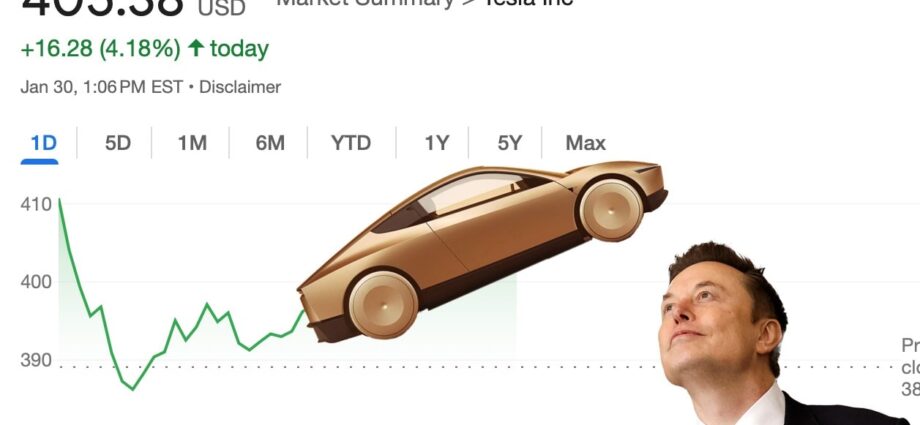

Tesla just reported its fourth quarter earnings, and (for the American automaker, at least) it’s relatively grim. It earned less per share than was expected, revenue from its automotive operations fell 8 percent (and of the $19.8 billion it made, $692 million in revenue is a result of it selling emissions credits to other companies), and deliveries—what Tesla reports instead of sales—dropped 1 percent in the first year-over-year downturn. If you think that’d be cause for investor alarm, you’d be wrong. That’s because of two promises Tesla CEO Elon Musk made during the investor call, which (as of this writing) caused the stock to jump roughly 4 percent.

The first is Musk’s promise that 2025 will be a year of growth, with more deliveries and more revenue expected this year. According to CNBC, Adam Jonas, the noted analyst at Morgan Stanley, noted that Musk didn’t address his previous promise of 20 to 30 percent volume growth in 2025. Tesla, Musk says, is now more focused on cost, with “more affordable models” coming. New products should drive growth, too, the company said, like launching its Full Self-Driving software suite in China and Europe this year.

The other tidbit that seems to have investors very excited is Musk’s promise that the company’s Cybercab Robotaxi, which we saw at a preview event last year, will go into volume production and start a paid passenger-carrying service in Austin, Texas, in June 2025. No additional detail on the service, or the vehicle itself, was provided beyond that.

We would be remiss not to note that Tesla (and Elon Musk, specifically) have made countless claims on timing and features of various products that have rarely been accurate, with autonomous capabilities suffering the most optimistic claims. It seems that the accuracy of Musk’s promises matters less than the overall trajectory of the company to investors, as the stock rally appears to indicate support for the company’s direction. Musk even poked fun at himself over the previous inaccurate promises during the call. However, given the investor interest and emphasis on the company’s revenue-generating robotaxi plans, it seems that Musk will have to deliver soon, even if he can’t hit his promised June 2025 target.