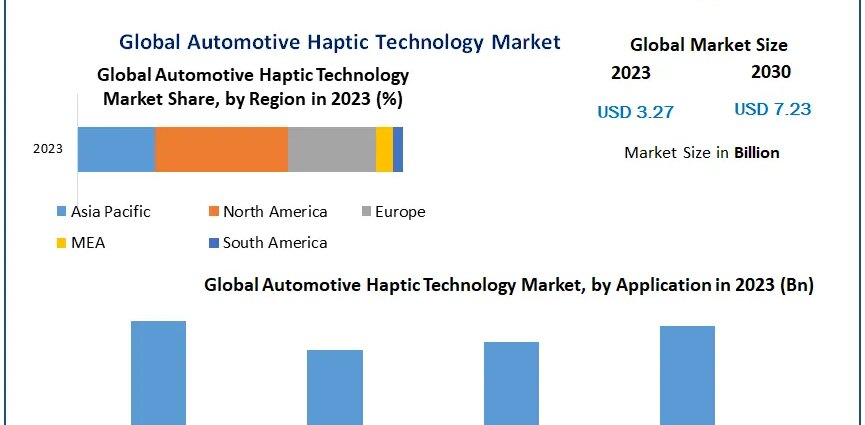

The Global Automotive Haptic Technology Market is witnessing remarkable momentum and is projected to grow from an estimated $3.27 billion in 2023 to over $7.23 billion by 2030, registering a robust CAGR of 12% during the forecast period. This growth reflects the automotive industry’s push toward intuitive, safe, and immersive driver experiences, increasingly enabled by haptic interfaces across human-machine touchpoints inside vehicles.

Market Definition and Estimation

Automotive haptic technology refers to systems embedded within vehicles that utilize tactile feedback mechanisms—such as vibration, force, or motion—to communicate with the driver. These systems are essential for enhancing the driver’s sensory connection to the car’s controls, infotainment features, and safety alerts, enabling both comfort and safety.

Haptic interfaces simulate the physical sensation of touch and are increasingly embedded into steering wheels, dashboards, infotainment units, pedals, and even car seats. With the expansion of semi-autonomous and electric vehicles, where conventional mechanical feedback is reduced, haptic technology provides essential cues to maintain driver awareness and interaction.

The market’s valuation—crossing $7 billion by 2030—underscores the automotive industry’s ongoing digital transformation, integrating advanced human-machine interfaces (HMI) as a standard.

Ask for Sample to Know US Tariff Impacts on Automotive Haptic Technology Market @ Sample Link:https://www.maximizemarketresearch.com/request-sample/85292/

Key Market Growth Drivers and Opportunities

1. Rising Adoption of Advanced Driver Assistance Systems (ADAS)

As automakers prioritize safety, the integration of haptic alerts in ADAS has surged. Haptic signals can guide drivers through lane-departure warnings, collision alerts, and blind-spot detection by providing non-visual cues, effectively enhancing reaction time and minimizing distraction.

2. Enhanced User Experience in Infotainment Systems

With the increasing reliance on touchscreen-based infotainment, haptic feedback is becoming essential in simulating button presses, thereby allowing drivers to interact with digital systems without diverting attention from the road. This contributes to a safer and more intuitive interface design.

3. Shift Toward Electric and Autonomous Vehicles

The transition toward EVs and autonomous vehicles is accelerating the demand for haptic systems. As mechanical engine feedback diminishes in EVs, haptics offer a new medium for delivering feedback. In autonomous vehicles, haptics provide the necessary transitional alerts between manual and automated modes.

4. Increasing Focus on Driver Comfort and Safety

From seat vibrations to steering wheel pulses, haptics is transforming how drivers receive warnings, navigational cues, or feedback from vehicle systems. This enhances comfort while reducing the cognitive load during driving.

5. Technological Innovations in Micro-Actuators and Sensors

Continuous development in actuator miniaturization and efficient sensor integration is reducing power consumption and space requirements, enabling broader implementation across all vehicle categories.

Segmentation Analysis

The automotive haptic technology market is segmented by application, component, feedback type, vehicle type, and sales channel.

By Application

-

Human-Machine Interface (HMI):

The most dominant segment, HMIs use haptic feedback in touch displays and control systems. Vibratory signals confirm user inputs in infotainment screens and climate control panels. -

Accelerator:

Haptic-enabled pedals provide gentle resistance or pulses to guide driving behavior, improving fuel efficiency and signaling driver fatigue or over-acceleration. -

Steering:

Steering wheels with embedded haptic feedback assist with lane-keeping and collision avoidance, delivering real-time tactile warnings. -

Seats:

Integrated haptic actuators in seats vibrate to signal navigation changes or imminent hazards, adding another safety layer for drivers and passengers.

By Component

-

Hardware:

This segment includes actuators, sensors, and controllers responsible for generating tactile sensations. It holds a substantial market share, given the reliance on physical components for feedback. -

Software:

Sophisticated algorithms translate touch inputs into responsive signals. As haptics becomes more complex, the software component continues to gain importance, especially in premium vehicles.

By Feedback Type

-

Tactile Feedback:

Common in infotainment and control panels, this provides short vibrations or pulses to mimic touch, useful in user interfaces requiring minimal driver attention. -

Force Feedback:

Offers resistance or pressure in systems such as steering and pedals, creating a realistic simulation of mechanical behavior and guiding driver actions more precisely.

By Vehicle Type

-

Passenger Vehicles:

Leading the segment due to high consumer expectations for advanced infotainment and safety systems, haptic technology is now a standard offering in many mid- to high-end vehicles. -

Light Commercial Vehicles (LCVs):

Used increasingly in logistics and urban deliveries, LCVs benefit from haptic features to alert drivers and improve navigation efficiency. -

Heavy Commercial Vehicles (HCVs):

Adoption is emerging, focusing on driver fatigue alerts and route guidance. Safety-related haptics in HCVs are projected to grow steadily during the forecast period.

By Sales Channel

-

Original Equipment Manufacturers (OEMs):

OEMs are embedding haptics directly into new vehicle models to align with modern safety and UI expectations. Integration at the production level ensures seamless design. -

Aftermarket:

This segment caters to existing vehicle owners seeking enhanced tactile feedback systems. Retrofit kits for haptic steering or pedals are gradually gaining traction.

To know about the Research Methodology:–https://www.maximizemarketresearch.com/request-sample/85292/

Country-Level Market Insights

United States

The U.S. market remains a major revenue contributor, fueled by a strong consumer demand for high-tech vehicles and safety systems. A well-developed electric vehicle ecosystem and growing investments in autonomous driving technologies are further driving the integration of haptics.

Manufacturers in the U.S. are focusing on premium features in passenger cars, such as infotainment units with tactile feedback and ADAS systems with steering alerts. The country’s regulatory focus on reducing distracted driving supports haptic feedback’s inclusion in more vehicle categories.

Germany

Germany’s position as a global leader in automotive innovation has spurred the adoption of haptic technology in both passenger and commercial vehicles. German automakers are known for emphasizing driver engagement and premium interior experience, with haptics becoming a key differentiator.

The country’s engineering expertise supports ongoing R&D into high-precision haptic systems, particularly in luxury car brands. With a strong export-oriented industry, Germany is also influencing haptic adoption trends globally.

Competitive Landscape

The automotive haptic technology market is moderately consolidated, with several global players competing on innovation, integration, and partnership strategies. Companies are prioritizing R&D and collaborating with software and sensor developers to improve performance, efficiency, and system responsiveness.

Key players include:

-

Continental AG – Innovating steering and HMI-based haptic systems.

-

Valeo – Specializing in comfort and driver alert feedback modules.

-

Harman International – Offering advanced infotainment with integrated haptics.

-

Visteon Corporation – Focused on haptic cockpit display solutions.

-

Alps Electric Co., Ltd. – Known for component-level haptic technologies.

-

Texas Instruments – Providing core processors and control units enabling haptic responses.

-

Johnson Electric – Leading in miniaturized actuator technologies.

-

AAC Technologies – Developing MEMS-based haptic feedback systems.

-

TDK – Involved in sensor integration for vehicle haptics.

-

Microchip Technology – Delivering microcontrollers for haptic functionality.

Conclusion

As the automotive industry redefines mobility with autonomous, electric, and connected vehicles, haptic technology is poised to play a critical role in enhancing driver communication and overall vehicle experience. By enabling non-visual, tactile feedback, haptics not only improves safety but also strengthens the emotional connection between driver and machine.

The rapid evolution of hardware and software platforms, combined with growing consumer and regulatory demands, ensures that haptics will continue to be a focal point for future vehicle development. From infotainment control to steering wheel alerts, haptic systems are quietly revolutionizing how we feel the road—and the machine.