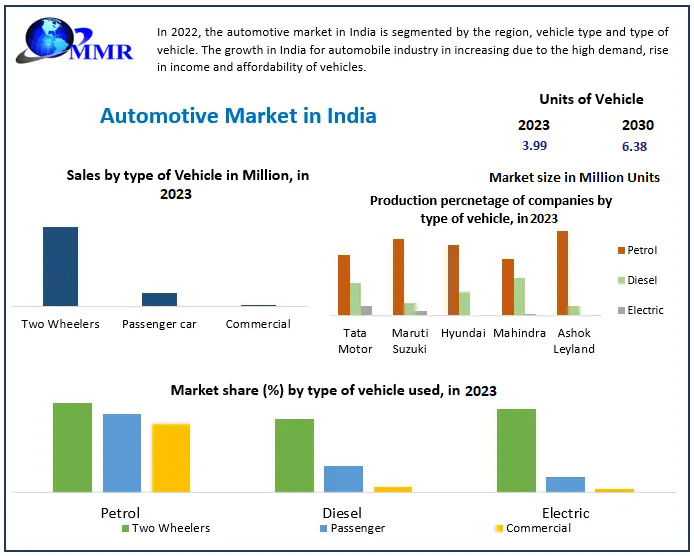

The Indian automotive industry is accelerating at an unprecedented pace, poised to expand from 3.99 million units in 2023 to a projected 6.38 million units by 2030. With a compound annual growth rate (CAGR) of 6.94%, India is emerging as one of the fastest-growing auto markets in the world. This growth is not only being driven by strong domestic demand but also by a rapid shift toward electric mobility, premium vehicle demand, and the increasing importance of sustainability in consumer choices.

This press release provides an in-depth look into the Indian automotive market, its segmentation, growth factors, global context, competitive landscape, and the market’s trajectory through the end of the decade.

To gain further understanding of this research, please consult:https://www.maximizemarketresearch.com/request-sample/86126/

Market Estimation & Definition

The Automotive Market in India encompasses the full ecosystem of two-wheelers, three-wheelers, passenger vehicles (PVs), and commercial vehicles (CVs), across internal combustion engine (ICE), hybrid, and electric vehicle formats. This includes both new vehicle sales and distribution as well as the supporting infrastructure for servicing, repairs, and parts.

In 2023, the market size stood at approximately 3.99 million units. By 2030, it is projected to cross 6.38 million units, with a CAGR of 6.94%. The industry is also expected to see a significant leap in value, with revenues forecast to nearly double over the next decade due to the expansion of premium segments and rising prices for high-tech and electric variants.

Market Growth Drivers & Opportunities

Key Drivers:

-

Urbanization and Infrastructure Growth: As more people move to urban centers, personal mobility solutions are increasingly in demand. Better roads and highways are also encouraging greater adoption of four-wheelers.

-

Rising Disposable Incomes: The expanding middle class in India is fueling demand for personal vehicles, particularly SUVs and sedans, as aspirations rise alongside incomes.

-

Policy Push for EVs: The Indian government’s continued push for electric vehicles through incentives, subsidies, and infrastructure development is a key market enabler. These efforts are influencing both supply and demand, with manufacturers rapidly introducing electric variants and customers warming up to EVs due to rising fuel costs.

-

Technology and Innovation: The integration of technology in vehicles—ranging from infotainment systems and connected services to ADAS (advanced driver-assistance systems)—is increasing vehicle appeal. These features, once considered luxury, are becoming standard in mid-range offerings.

-

Global Supply Chain Integration: India’s strong supplier base and competitive labor costs are making it an attractive hub for global automotive manufacturers, creating new export opportunities and encouraging local component production.

Opportunities:

-

Electrification: The rapid expansion of the electric vehicle ecosystem presents massive opportunities across the value chain—from battery production and charging infrastructure to EV-specific dealerships and service networks.

-

Rural Market Penetration: With significant untapped potential in rural areas, OEMs are customizing models and distribution strategies to suit the needs of semi-urban and rural consumers.

-

Export Potential: Indian automotive manufacturers are increasingly becoming global exporters, particularly for compact cars, two-wheelers, and small commercial vehicles. This opens up further investment and revenue-generation opportunities.

-

Aftermarket Services: As the total vehicle population rises, demand for spare parts, accessories, and services is also increasing, creating lucrative after-sales opportunities for both OEMs and independent service providers.

Market Segmentation Analysis

The Indian automotive market can be segmented into three major categories: by vehicle type, by fuel type, and by distribution channel.

A. By Vehicle Type

-

Two-Wheelers: This segment continues to dominate the Indian landscape with the highest volume, especially in rural and semi-urban areas. Motorcycles and scooters remain the primary means of transportation for many Indian households, offering affordability and fuel efficiency.

-

Passenger Vehicles (PVs): Comprising hatchbacks, sedans, SUVs, and MUVs, this segment is growing steadily, with SUVs witnessing the most aggressive growth. Consumer preferences are shifting toward vehicles that offer a blend of comfort, space, and high ground clearance.

-

Commercial Vehicles (CVs): Demand in this segment is driven by logistics, infrastructure development, and industrial activities. Light commercial vehicles (LCVs) and medium-heavy commercial vehicles (MHCVs) serve essential roles in goods transport and fleet services.

-

Three-Wheelers: Used mainly for intra-city and last-mile transportation, the three-wheeler segment is undergoing a transformation with increasing electrification. Electric rickshaws are gaining popularity due to lower operating costs and environmental benefits.

B. By Fuel Type

-

Internal Combustion Engines (ICE): Petrol and diesel vehicles still form the majority of the market. However, diesel share has seen a steady decline due to environmental concerns and policy discouragement.

-

Compressed Natural Gas (CNG): CNG vehicles are popular in urban areas where infrastructure is available. These offer a cheaper and cleaner alternative to petrol or diesel.

-

Electric Vehicles (EVs): The fastest-growing segment, bolstered by government support, falling battery prices, and improved consumer confidence. Battery Electric Vehicles (BEVs) dominate this category, followed by hybrid and plug-in hybrid electric vehicles (HEVs and PHEVs).

C. By Distribution Channel

-

Offline Dealerships: Still the dominant channel due to the importance of physical presence, trust-building, and after-sales services.

-

Online Sales and Digital Platforms: Gaining ground, particularly among younger, tech-savvy consumers. Online vehicle purchases and digital financing options are becoming increasingly popular.

Get in touch with an analyst to personalize your report:https://www.maximizemarketresearch.com/request-sample/86126/

Country-Level Analysis: USA and Germany

United States:

The U.S. market is a mature and technologically advanced auto ecosystem, with strong adoption of SUVs, pickup trucks, and electric vehicles. Major manufacturers like Tesla, GM, and Ford dominate the EV space, offering lessons in scaling EV production, marketing, and grid integration.

Indian manufacturers are increasingly studying and adopting best practices from the U.S. market, particularly in terms of product innovation, safety technologies, and electrification. India’s EV growth strategy mirrors some of the U.S. models, especially in infrastructure and battery manufacturing.

Germany:

As one of Europe’s automotive powerhouses, Germany leads in engineering excellence, safety standards, and electric mobility. Companies like Volkswagen, Mercedes-Benz, and BMW are transitioning aggressively toward sustainable transportation.

Indian OEMs and component suppliers are looking to align with German standards, enabling them to expand their global footprint. The technology exchange between Indian and German firms is fostering innovation in autonomous driving, lightweight materials, and battery efficiency.

Competitor Analysis

The Indian automotive landscape is highly competitive and diverse. Key players include both domestic giants and multinational corporations:

-

Tata Motors: A leader in both commercial and passenger vehicle segments. It has made significant strides in EV development, becoming one of the top EV sellers in India.

-

Mahindra & Mahindra: Known for its rugged SUVs and commercial vehicles, the company is investing heavily in electric mobility and digital transformation.

-

Maruti Suzuki: India’s largest car manufacturer by volume, with a strong dealer network and an expansive rural market footprint. It is expected to launch several EVs in the coming years to retain its leadership.

-

Hyundai & Kia: These South Korean manufacturers are focused on high-value offerings, including feature-rich SUVs and early entry into the EV segment.

-

Honda, Toyota, and MG Motor: Focused on hybrid technologies and expanding their EV lineups.

-

Emerging Players: Startups and niche players like Ather Energy, Ola Electric, and Hero Electric are disrupting the two-wheeler and three-wheeler space with innovative EV models.

Competition is intensifying not just on pricing but also on technology, customer service, sustainability, and brand value.

Press Release Conclusion

The Indian automotive industry is standing at the crossroads of a transformative decade. With a projected CAGR of nearly 7% and the potential to sell over 6.3 million vehicles annually by 2030, the country is poised to emerge as a global automotive powerhouse.

This growth will be underpinned by a confluence of demographic expansion, government policy, infrastructure development, electrification, and consumer aspiration. Manufacturers who adapt to the changing landscape—by investing in green technologies, digital transformation, and rural outreach—are expected to thrive.

India’s journey from a price-sensitive market to a value-driven, innovation-led automotive hub is well underway. With the right strategic investments and policy support, the nation is on course to redefine its position in the global auto value chain.