From a typological standpoint, investors are widening their scope beyond standardised urban hotels. While business and leisure properties in major city centres continue to play a foundational role, market players now incorporate complementary segments: lifestyle hotels, boutique hotels, hybrid concepts (coliving, premium hostels, serviced apartments) and resorts.

This diversification makes it possible to smooth cycles by combining assets with different demand profiles (business vs leisure, seasonal vs year-round) and to optimise operational returns through differentiated economic models. It also responds to shifts in demand, marked by the rise of bleisure, long stays and the search for more authentic experiences.

Geographical diversification constitutes the second pillar. While mature markets such as Paris, London and Rome remain essential, they are now balanced by investments in secondary or emerging markets: Southern Europe, Central Europe, and the Nordic countries. These territories offer more attractive acquisition values, stronger RevPAR growth potential and lower competitive saturation. This pan-European approach enables investors to balance risks and performance within a single portfolio.

Finally, ownership and operating structures are undergoing strategic evolution. Investors now combine several models:

• Property-only ownership, favoured for securing stable rental income

• Property + business assets, allowing stronger value creation through repositioning or active management

• Management contracts or franchises, offering flexibility and shared operational risk

• Some players, notably family offices or opportunistic funds, even position themselves as owner-operators, integrating the entire value chain to maximise margins

These choices reflect a common objective: reducing dependence on a single model, anticipating economic cycles, adapting to new traveller behaviours and exercising tighter control over operational performance in a transforming real estate environment. Diversification is no longer a tactical move; it has now become a strategic architecture at the core of contemporary hotel investment policies.

Lifestyle keeps winning hearts

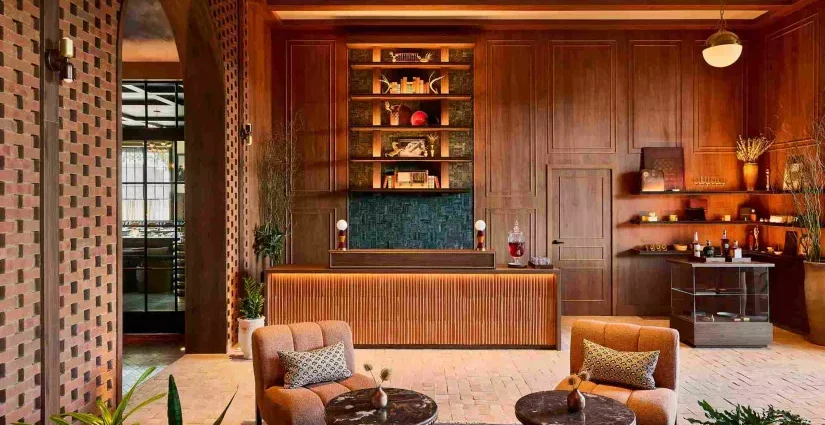

Although there is no official definition of lifestyle hospitality, these hotels can be described as places that offer experiences seamlessly aligned with travelers’ lifestyles, places where guests feel at home, only better.

Between 2023 and 2025, this segment represents one in every four hotels built. Lifestyle hospitality is no longer seen as a niche sector, it now stands among the fastest-growing segments, alongside luxury. Designed to meet new customer expectations, lifestyle hotels have taken over both the hospitality landscape and the pipelines of major international groups.

As Cédric Gobillard (COO Europe, Ennismore) summarized during a previous edition of the Hospitality Operator Forum, lifestyle has transformed hotels into living spaces where travelers and locals intersect. This is one of its core strengths, targeting a broad spectrum of guests allows these properties to maintain steady footfall throughout the year.

To appeal to such a diverse clientele, lifestyle hospitality has made F&B&E (E for entertainment) its flagship offering. This component is central to the segment, typically accounting for more than 60% of total revenue.

“With the current recovery [in 2023], whether in Paris, Germany, or the French regions, more than 65% of our total revenue comes from F&B. This makes it particularly interesting in terms of per-square-meter optimization.”- Cédric Gobillard, COO Europe, Ennismore

The goose that lays the golden (and high-priced) eggs

Food halls, trendy bars, karaoke rooms, and coworking spaces are all ways to maximize every square meter of a lifestyle hotel in order to “create differentiated products with far more levers to drive profitability” explains Keith Evans (CEO, Lifestyle Hospitality Capital Group).

This value creation through complementary offerings ultimately leads to higher yields than so-called “traditional” hotels, but it also comes with trade-offs. Generating more than half of a property’s revenue through F&B&E is indeed an opportunity, but also a “heavy responsibility” warns Benoit Amado (VP Europe and USA, Gaw Capital Group).

Operating such spaces usually involves high running costs. Both the initial investment and potential future expenditures must be considered to ensure the F&B&E offer remains relevant and aligned with evolving guest expectations.

It is also important to remember that the returns from these properties are less predictable than those of more traditional hotels. “We understand that the risk-return profile of a lifestyle hotel is not suited to all investors” concedes Felicity Black-Roberts (VP Development EMEA, Hyatt).

The lifestyle race is heating up

This unpredictability has not made the segment any less attractive. Proof lies in the recent race among major global hotel groups to launch or acquire lifestyle brands.

Accor offers a perfect illustration through a joint-venture established in 2021, the group made Ennismore its lifestyle spearhead. The strategy has paid off, with Accor reporting a 63% increase in revenue in Q1 2023, supported by a 68% surge in lifestyle division sales, reaching €477 millions.

“While the positive [2023] figures stem partly from Asia’s rebound at the end of the health crisis, the success of lifestyle hospitality should not be overlooked.” – Sébastien Bazin, Chairman and CEO, Accor

Growth potential has not gone unnoticed. In 2022, a consortium of Qatari investors acquired a 10.8% stake in Ennismore from Accor. The €185 millions transaction underscores the segment’s strong appeal to investors.

The lifestyle divisions of major groups continue to expand. Hyatt, for instance, plans to open around fifty lifestyle hotels by 2026. This strategy includes external growth, exemplified by its 2024 acquisition of Standard International, which operates 22 properties in this segment.

Hilton is following a similar path with its acquisition of Graduate Hotels and NoMad, along with the appointment of Kevin Osterhaus as Global President of Lifestyle Brands. IHG has joined the race as well, recently acquiring Ruby Hotels, which boasts a robust pipeline in both Europe and the United States.

When extended stays mean high returns

Serviced residences, also known as branded residences, are experiencing some of the strongest growth in the hospitality sector. According to Future Market Insights, the global market is expected to grow from 62.8 billion dollars (53.5 billion euros) in 2025 to 143.2 billion dollars (122 billion euros) by 2035. This market is considered one of the most promising segments in the industry.

Unshakable resilience

While serviced residences initially targeted business travelers, the offer now appeals to a much broader audience, including leisure tourists. This evolution of the guest mix has occurred naturally, reflecting shifting behaviors and expectations among contemporary travelers.

The rise of new trends such as digital nomadism, bleisure, and workation has fueled the exponential growth of this segment over the past decade. Its development continues as the boundaries between business and leisure travel become increasingly blurred.

While the hotel industry was severely impacted by the health crisis, the extended-stay segment demonstrated remarkable resilience. Indeed, while many hotels were forced to close their doors during that unprecedented period, serviced residences were able to continue operating. This resilience, combined with the segment’s strong fundamentals, has attracted growing interest from investors.

“Covid has truly triggered the recent growth of branded residences, coupled with the fact that people now have multiple residential bases from which they can work remotely, which has contributed to this growth. This represents a great opportunity for developers and investors to continue expanding this activity.” – Alexandra Yao, Vice President, Global Branded Residences, IHG Hotels & Resorts

The number of remote workers has skyrocketed since the pandemic, rising from 5% of the global population before 2020 to nearly 30% (average estimate) by 2025. This increase is now fueling the strong demand for this segment.

A trend that crossed the Atlantic

As often happens, this segment originated in the United States, where its development was both earlier and more pronounced. Dedicated extended-stay brands have flourished across the Atlantic, with Marriott, Hilton, and Choice leading the way.

These three major American groups have each expanded their extended-stay portfolios over the years, with each operating more than five brands dedicated to this segment. Marriott operates the Residence Inn brand, which had 149,130 keys according to MKG’s 2024 global hotel brand ranking, placing it in 29th position.

Three of Hilton’s extended-stay brands also feature in MKG’s top 100: Home2 Suites by Hilton (70,436 keys, 49th place), Embassy Suites by Hilton (61,844 keys, 57th place) and Homewood Suites by Hilton (61,624 keys, 58th place). The group also launched a new brand in 2024, LivSmart Studios by Hilton, further strengthening its extended-stay portfolio.

“With a 300 billion dollar workforce market, the extended-stay segment continues to grow. It has never been better positioned for this long-stay brand, and we are thrilled with the initial enthusiasm we have received from owners.” – Isaac Lake, Chef de marque, LivSmart Studios by Hilton

Europe is also experiencing rising demand for this type of accommodation. Accor is responding to this trend through its Adagio aparthotels, as well as through newer concepts derived from established brands, namely Novotel Living and Mercure Living. The latter is set to make its debut on the German market in the second half of 2026, in Heide.

Other global groups are also very active, such as Ascott Ltd, which covers all market segments: business with Citadines, high-end with Ascott and Lyf.

A segment with undeniable strengths

Beyond its resilience and growing demand, the extended-stay segment offers other significant advantages. Operational costs for these properties are much lower than those of traditional hotels because they do not rely on complex F&B spaces and require far less staffing. Ultimately, yields are higher and operations are simpler to manage.

“This growth is not just about volume. With lower operational costs and higher profitability, hotels offering extended stays are both resilient and well positioned to optimize their revenues.” coûts opérationnels plus faibles et une rentabilité plus élevée, les concepts offrant des séjours longue durée sont à la fois résilients et prêts pour optimiser leurs revenus. » – Camil Yazbeck, Global Chief Development Officer – Premium, Midscale & Economy, Accor

Although still moderately fragmented, the market nonetheless has barriers to entry due to capital intensity, regulatory hurdles such as zoning and construction permit restrictions, as well as the strength of already established brands.

There is, however, an opportunity to be seized by focusing on underserved suburban and secondary urban markets, since most of the current offer is concentrated in major cities. And while the market is not yet saturated, targeting underexploited areas could prove strategic, offering attractive growth dynamics away from highly competitive environments.