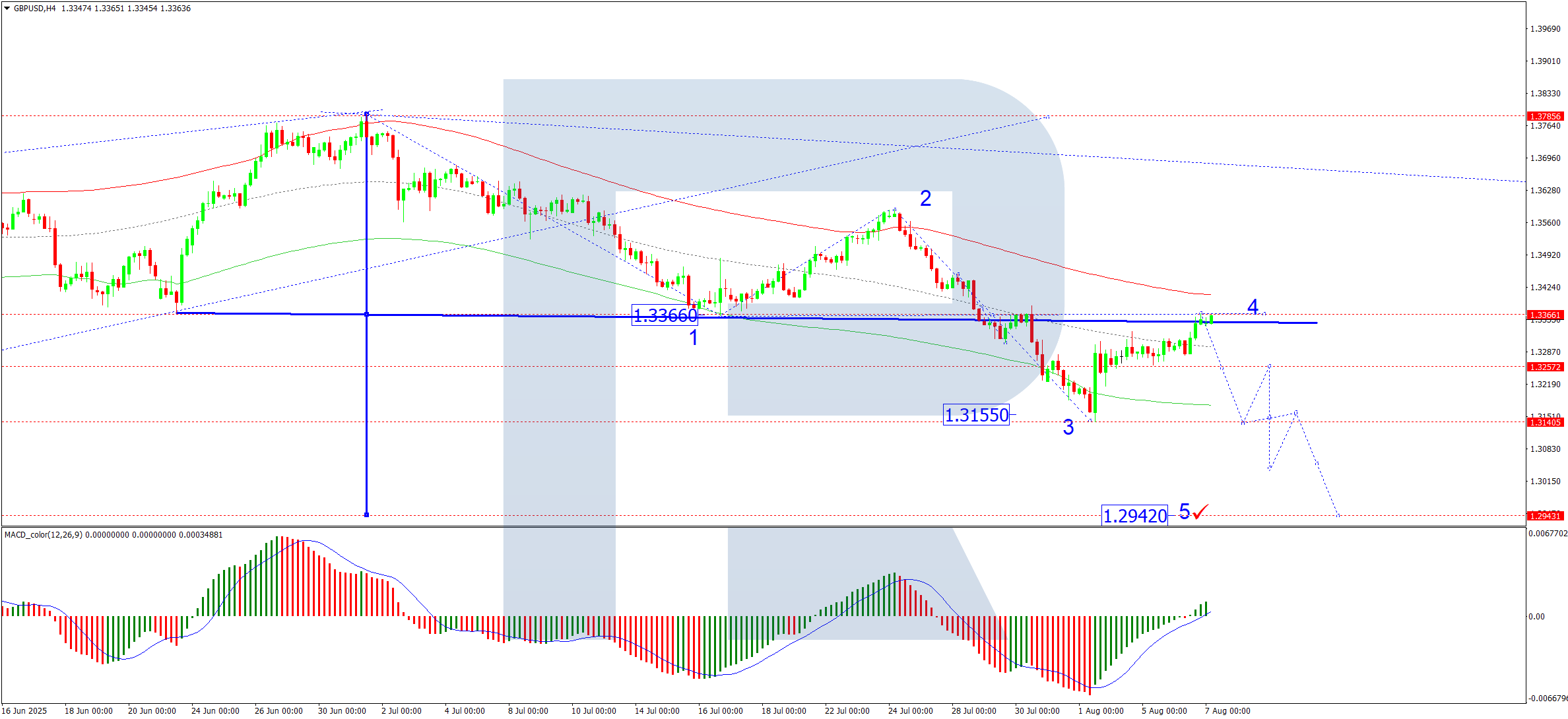

GBP/USD Forecast: Pound Sterling tests key resistance, eyes on BoE

GBP/USD holds its ground and trades above 1.3350 after posting strong gains on Wednesday. Investors stay on the sidelines while waiting for the Bank of England (BoE) to announce monetary policy decisions.

The renewed selling pressure surrounding the US Dollar (USD) allowed GBP/USD to gather bullish momentum on Wednesday. US President Donald Trump’s renewed tariff threats revived concerns over the US economic outlook and weighed on the USD. Read more…

Pound under pressure ahead of Bank of England meeting

The GBP/USD pair climbed to 1.3355 on Thursday as markets braced for today’s Bank of England (BoE) meeting. Traders are closely watching two key factors: the voting split among Monetary Policy Committee (MPC) members and any signals regarding future rate moves.

The central bank is widely expected to cut interest rates by 25 basis points (bps) to 4.00%. However, there is speculation that some members, such as Swati Dingra or Alan Taylor, could push for a more aggressive 50 bps reduction, as seen in May. Should this occur, particularly if accompanied by a shift away from the BoE’s usual cautious tone, the pound could come under significant selling pressure. Read more…

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.