Markets

US stocks are bouncing back from yesterday’s tech hiccup, with smaller sectors flourishing today, thanks to a steady US growth outlook and improved visibility into Fed rate cuts. The labour market has been more resilient than feared, and that’s providing the boost for today’s mini-sector rotation.

Nvidia is also gathering momentum at midday in New York, leading a chipmaker rebound and lifting the broader index( S&P 500). Investors seem willing to look past uneven growth spurts at some global tech giants outside the Mag 4/7, like the AMSL curveball. With AI rapidly becoming a dominant force across multinational corporations, it’s hard not to envision Nvidia shares rising on the surging demand for its AI GPUs in 2025. Though Nvidia stock has been flat due to doubts surrounding its AI prospects and sustained growth, it wouldn’t be surprising to see it regain its mojo for another stellar year in 2025.

Speaking of tech giants, all eyes are on today’s TSMC’s earnings report as the chip industry finds itself on shaky ground, grappling with concerns over uneven demand. This week’s sell-off in semiconductor stocks and rising doubts about the near-term prospects for AI-driven growth have heightened the stakes for Taiwan Semiconductor Manufacturing Company’s results. While the market expects TSMC to hit or exceed revenue targets, the main focus will be its 2025 guidance. AI investors anxiously await any signs of an industry 2025 boost, particularly after ASML’s gloomy forecast sent shockwaves through semiconductor stocks earlier this week.TSMC’s outlook could either stabilize or exacerbate the current market jitters, making their guidance a critical bellwether for the tech sector’s year-end run

On the earnings front, Morgan Stanley is stealing the spotlight with a 7% surge as banks continue to shatter expectations. A 32% profit jump in Q3 has traders buzzing and signalling that the financial bulls are far from finished.

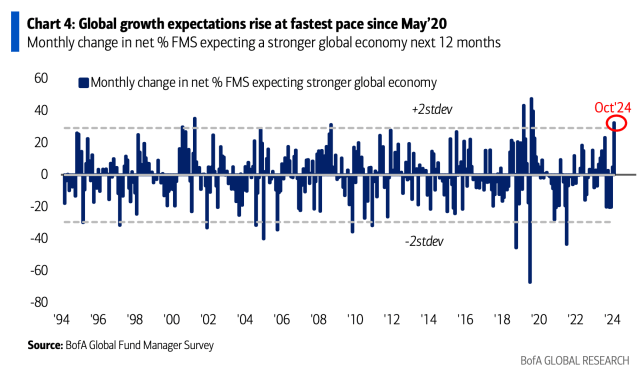

Despite the doomsayers, BoA’s latest Global Fund Manager survey shows global growth expectations surging from -47% to -10%, one of the biggest jumps since 1994. Between the Fed’s rate cut, China’s stimulus attempts (which might finally stem the bleeding), and September’s blowout US jobs report, it’s becoming clear that smart money is backing the rally.

With a holiday bull run looking more likely by the day, don’t be surprised if the S&P 500 rockets toward the 6000 mark by year-end—a champagne-popping moment for sure.

Of course, as always, the real risks are the ones no one sees coming. However, with the pain trade pointing upward, hedge funds may soon have no choice but to dive into the rally.

Forex Markets

On the currency front, the US dollar is bid again overnight. The pound is under pressure, weighed down by a disinflation bomb in weaker services CPI. The euro is vulnerable as the ECB may have to ring the dovish bell soon, and the yen is weakening with no signs of a more hawkish stance from the BoJ (which likely won’t materialize until after the local election on October 27). Yet, beneath these headlines, the Trump trade is gaining steam as the former president surges ahead in the betting polls. Trump’s threat of renewed tariffs drives dollar pre-election hedging demand, even as 10-year yields inch lower.

The Republican candidate’s tough stance on tariffs against virtually everyone has FX traders betting that a Trump victory would mean more pain for foreign economies, making the greenback all the more attractive. Trump has vowed that under his watch, the dollar’s reserve status will be “the strongest it’s ever been,” and the market is starting to believe it.

Oil Markets

Oil prices have been stabilizing, though still hovering at the lower end of the recent range, as much of the geopolitical risk premium has eased. This came after a Washington Post report suggested Israel would avoid targeting Iran’s oil infrastructure, leading to a significant unwinding of correlated long oil hedges. However, a solid Middle East risk premium remains embedded in the market, fueled by concerns that Israeli Prime Minister Netanyahu could take decisive military action against Iranian proxies in response to any deadly attack, potentially including strikes on critical Iranian assets.

The ongoing tension in the Middle East keeps the region on high alert, preventing oil prices from falling further and maintaining a floor under the market. A “just-in-case” bid may creep in as we approach the weekend, especially with the potential for sudden escalations over the weekend that traders can not react to. Still, ample global supply should keep gains in check—unless Israel’s actions spark a broader conflict, all long bets could be off on Monday.

We’re not alone in believing that EVs and the rise in solar power could disrupt the oil market, as Edison’s light bulb did to the candle factory. The International Energy Agency (IEA) calls it: “We’ve witnessed the Age of Coal and the Age of Oil — and we’re now moving at speed into the Age of Electricity,” the advisor to major economies declared in its annual long-term report.

Crude price trends are adding weight to this bearish outlook. In the past, clashes between Israel and oil heavyweight Iran might have sent prices rocketing into triple digits, but now, oil is barely hanging near $75 a barrel. This lacklustre response reinforces the idea that oil has lost its spark, and we’re witnessing a seismic shift in the global energy landscape. The buzz is gone, and the Age of Electricity is on the rise