By Rystad Energy – Mar 26, 2025, 4:00 PM CDT

- New US sanctions on Iran, specifically targeting Chinese refineries, aim to increase economic pressure and compel Iran to renegotiate a nuclear deal, but these actions also risk disrupting global energy markets and increasing oil prices.

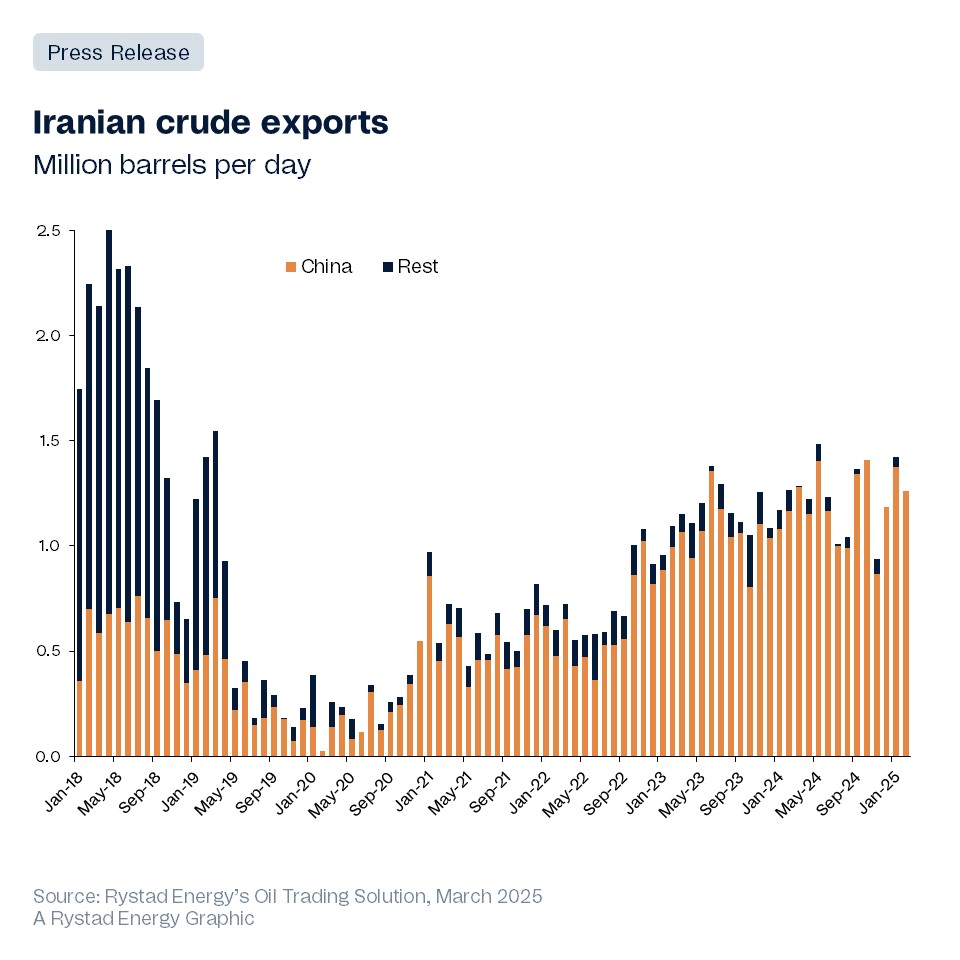

- China’s cooperation is crucial for the US to achieve maximum pressure on Iran, as almost all Iranian crude exports go to China, and the effectiveness of the sanctions depends on whether China reduces or ceases its purchases.

- OPEC Plus’s decision to increase oil production may provide the US with a strategic advantage in imposing stricter sanctions on Iran, as it could help offset any potential loss of Iranian exports and maintain stable global oil prices.

The latest round of US sanctions on Iran, which now targets Chinese so-called ‘teapot’ oil refineries—small, independently owned facilities—signals a growing determination to tighten the economic noose around the Tehran administration. With potential consequences reaching far beyond Iran itself, these moves could reshape geopolitics, disrupt the global economy and send shockwaves through energy markets.

While there is not yet a “maximum pressure” situation—where Iranian oil exports could drop from 1.5 million barrels per day (bpd) to near zero—Washington is stepping up efforts to push Tehran back to the negotiating table for a new nuclear deal. However, escalating pressure could drive oil prices higher, conflicting with US President Donald Trump’s goal of lowering energy costs to fight inflation, as he promised in his January inauguration speech. Rystad Energy’s data on oil trade flows shows that almost all Iranian crude exports make their way to China, so achieving effective maximum pressure would require cooperation from the Chinese government.

Targeting a Chinese buyer may also signal pressure on China, the largest importer of Iranian oil, to reduce or cease its purchases. This is the fourth round of sanctions, and the pressure is intensifying with each one. Just days before, the US had revoked a sanction waiver that allowed Iraq to purchase electricity from Iran, further tightening the economic squeeze on Tehran,

Jorge León, Head of Geopolitical Analysis, Rystad Energy

Learn more with Rystad Energy’s Oil Trading Solution

The effectiveness of these sanctions in compelling Iran to negotiate is still unclear. Rystad Energy analysis suggests that, if Iran remains unresponsive, the US could introduce further sanctions. Trump has repeatedly signaled his desire for a new nuclear deal, urging Iran to return to the negotiating table. While the immediate effects of these sanctions may be limited, they send a clear signal about the US administration’s intent to escalate pressure on Iran

In addition, the decision by OPEC+ to increase production could play a key role in shaping the US approach to maximum pressure on Iran. The recent drop in oil prices—partly due to the production boost from OPEC+—might create a favorable environment for the US to impose stricter sanctions on Iran.

With oil prices hovering around $70 per barrel, the current market conditions could give the US a strategic edge. OPEC+ may be ramping up production in anticipation of potential US sanctions, helping to offset a loss of up to 1.5 million barrels per day of Iranian exports without destabilizing global oil prices,

Jorge León, Head of Geopolitical Analysis, Rystad Energy

Strikingly, Iranian crude exports surged in January to almost 1.5 million bpd, the highest figure since May 2024 and the second highest since March 2019. This increase may indicate Tehran’s expectations of forthcoming US pressure.

More Top Reads From Oilprice.com

- U.S. Considers New Fees on Chinese-Built Ships

- Reports Suggest China Could Participate in Ukraine Peacekeeping Mission

- Palisades Nuclear Plant Revival Sparks Industry Interest